Closed Seminar | The Time of Debt and the Economy of Guilt With Sami Khatib

In his fragment “Capitalism as Religion” (1921), Walter Benjamin sketches the outlines of an a-theological religion, which he claims has emancipated itself like a parasite from its historical “host,” the mythical-pagan elements of Christianity, in order finally, in capitalism, to install its own cult as a mere cult, as cult praxis without theology. This capitalist “religion of pure cult, without dogma” is located in the descent of a totalizing movement towards the culpability (Verschuldung) of everything living. For every investment in the retribution of guilt (Schuld) increases the total guilt. The totalizing trajectory of capitalist guilt relations points to the “demonic ambiguity” of the German word for guilt: Schuld is both moral guilt and economic debt (Schulden). In this seminar, we take Benjamin’s reference to Nietzsche’s Genealogy of Morals as a starting point to explore the specific capitalist temporalization of this ambiguity, which Marx theorized as the socio-temporal relation of labor, capital and credit. If in capitalism every “here and now” of the expenditure of labor-power is commensurable with any other, time and space become abstract expressions of the social relation formed by labor, capital and credit. This relation is accelerating and self-totalizing; it is not limited to economy but also affects and preconditions the moral foundation of the modern subject, which, as Maurizio Lazzarato argues, becomes the “Indebted Man” (2012). Drawing on Benjamin, Nietzsche and Marx, we will put Lazzarato’s claim to the test according to which the “creditor-debtor relation is itself a power relation, one of the most important and universal of modern-day capitalism.”

Closed Seminar | The Space of Capital and the Time of Dying With Sami Khatib

It belongs to the peculiarities of conformist historiography that the current age conceives of the earlier ones as transitory stages leading up to itself. Today, the Western model of capitalism posits itself as the best of all possible worlds; a natural outcome and endpoint of all historical development. From this perspective, all other histories appear as detours, diversions, or delays on the way to the latest stage of capitalist (post)modernity. Although the rise of capitalism with “Asian values” has challenged the view that the West represents capitalism’s highest stage and privileged place, the basic idea of a linear normative development remains unquestioned. If capitalist modernity defines the only model of social and political development, the very distinction between capitalism and modernization becomes tautological. Cultural theorist Mark Fisher aptly called this view “capitalist realism” – the tautological identity of what capitalism pretends to be and what its modern history actually is. If in the age of capitalist realism, capitalism “seamlessly occupies the horizons of the thinkable” (Fisher), history shrinks to the size of the (pre)history of the capitalist present. Moreover, with the “increasing predominance of space over time” (Fredric Jameson), this “age” is not anymore conceived of in historical terms. The future to which the present space of capitalism is infinitely indebted is not a real future but a speculative future past. What enters the economic consciousness only in the guise of manageable “toxic assets” or “toxic debt” is actually an intoxicated time: a spectral time that has been consumed in space before it was lived in time. If today’s financial capitalism is devalorized, annulled by a future past that will never arrive in the present, we can only witness its prolonged “time of dying.” As Walter Benjamin stated already in the 1930s: “With the destabilizing of the market economy, we begin to recognize the monuments of the bourgeoisie as ruins even before they have crumbled.”

Sami Khatib is a visiting professor of art theory at the American University of Beirut. His work spans the fields of aesthetic theory, critical theory, media theory and cultural studies with a special focus on Walter Benjamin, early Frankfurt School, Kant, Nietzsche, Marx, Freud and post-Structuralism.

Seminar | With Ray Brassier

Open to registration | Wednesday, May 17th | 2:30-5:30PM

This seminar will examine the role played by notions of chance, contingency, and probability in recent philosophical work on finance capital and markets

Ray Brassier is a member of the philosophy faculty at AUB. He is the author of 'Nihil Unbound: Enlightenment and Extinction' (Palgrave 2007) and the translator of works by Alain Badiou and Quentin Meillassoux.

Seminar | Semiotic and Financial Globalization With Ana Texeira Pinto

Open to registration | Wednesday, Tuesday, May 30th | 2:30-5:30PM

Not so long ago, buttressed by a wealth of biennials, festivals, symposiums and art centers, the rapid globalization of contemporary art seemed a growing certainty. Independent of modern master narratives (universal history, humanist universalism, socialist international), but reliant on the conceptual idioms and formal grammar developed by modernist art-forms, this vibrant “global art” sought to expand the western canon via geographic decentralization, to Japan, South America or South East Asia. The result was a plethora of neo-conceptualisms, flanked by pop histrionics on the more commercial end of the spectrum, and by institutional critique on state-sponsored platforms. Neo-conceptualism’s gesture toward a semiotic universal was swiftly overhauled by the spectacular narratives of success and value ushered in by the art market and more recently, by a rampant polarization of the cultural sphere. In this seminar we will examine the intersections between art and finance, the chimera of the global museum and the materialities of globalization.

Seminar | Capital /Money /Memory With Ana Texeira Pinto

Open to registration | Wednesday, May 31st | 2:30-5:30PM

Capital, Bichler and Nitzan argue, has no ‘natural unit’ of measurement: there is no simply way to add up its components: how would you account for things as heterogeneous as plots of land, oil rigs or technological innovation? The monetary magnitude of capital cannot be observed or quantified directly; it reveals itself to us through the pricing system: money is the medium through which capital acts socially. According to Matteo Pasquinelli, Money can be regarded as an abstract machine like others that replaces and amplifies previous social relations. As any other machine, it can be analyzed according to its inputs and outputs, to the division of labor and to the social relations that it engenders. Capital is thus not a narrow economic entity, but a symbolic quantification of power. In this seminar we will try to describe this process of capital accumulation as state formation.

Public Talk | Semiotic and Financial Globalization With Ana Texeira Pinto

Thursday, June 1st | 8PM

Ana Teixeira Pinto is writer and cultural theorist based in Berlin. She is a lecturer at Universität der Künste, Berlin, and a research fellow at Leuphana University, Lüneburg. Her writings have appeared in publications such as e-flux journal, art-agenda, Mousse, Frieze/de, Domus, Inaethetics, Manifesta Journal, or Texte zur Kunst. She is the editor of The Reluctant Narrator (Sternberg Press, 2014) and has recently contributed to Alleys of Your Mind: Augmented Intelligence and its Traumas (edited by Matteo Pasquinelli, 2015) and Nervöse Systeme (edited by Anselm Franke, Stephanie Hankey and Marek Tuszynski, 2016)

Seminar | Practical seminar With Elie Ayache

Open to registration | Tuesday, June 6th | 2:30-5:30PM

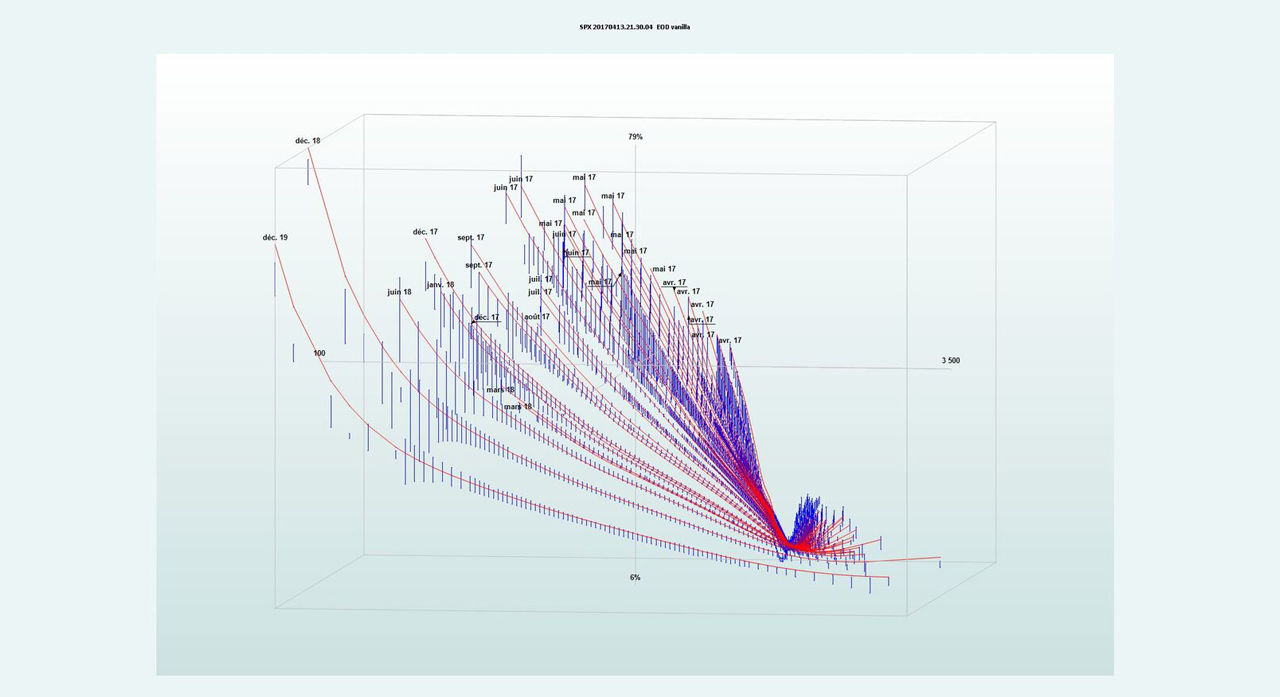

Ayache will introduce how he came to the financial market and to the trading of derivatives in open outcry markets, and describe the mechanisms of open outcry. The seminar also describes the mechanics and structures of financial derivatives and why, for all their complexity, they become 'basic' again as soon as they are traded, in their turn, in the market. Ayache will introduce the basic principles of derivative pricing theory and the principle of non-arbitrage. He will present the Black-Scholes model, the problem it has solved and the problem it has created (known as 'the volatility smile problem'). Throughout his presentation, Ayache will demonstrate the cutting-edge software that his company has developed. It will take the participants into the heart of the technological problem that the post-Black-Scholes pricing of derivatives pose and of the way to solve it. This problem is very challenging not only computationally, but also theoretically and philosophically. It is the reason why the critical thinkers of finance who are not familiar with it and with the technology to solve it, such as sociologists of finance, philosophers and authors in critical theory, stop at the criticism of Black-Scholes, and a very narrow view of the derivatives market and its meaning, especially in relation with the future, the event and contingency. To the contrary, the wealth of derivatives prices that Ayache claims to demonstrate, as well as the richness of their structures, will put us directly in contact with the matter of the market and its full writing capacity. If anything, it shows what the 'massive' and non-naive view of the future and of the contingent event should look like.

Seminar | Theoretical seminar With Elie Ayache

Open to registration | Wednesday, June 7th | 2:30-5:30PM

This seminar will cover Ayache’s research in the metaphysics of finance and the derivatives market. The investigation will first take us into the foundations of modern probability theory, also known as 'abstract probability theory'. He will try to show how the association of randomness and probability first inspired the foundational system of Richard von Mises (1919), which was soon to be superseded by the axiomatic system of Andrei Kolmogorov (1933). This was due to von Mises's reliance on the 'intuition' of randomness and his insistence on keeping a link between formalized probability and 'real world probability'. By contrast, the concept or 'random variable', introduced by Kolmogorov, and its success in formally showing the strong law of large numbers, point to a conception of randomness that lies deeper than the intuitive view of randomness and random generators, and statistical frequencies. It shows distinctions that thought has to make, when it thinks the world, between what Ayache call the 'concrete' and the 'real'. It is at this deep level of the archaeology of thinking that, he claims, the category of money emerges. Money is an alternative way of wiring the logic of the concrete and the real, hence an alternative way of introducing the matter of contingency inside the formalism of possibility and probability. No wonder that 'capital processes', also known as 'martingales', enter at the foundational level of probability theory and offer a more powerful characterization of randomness. This is already recognizable in the work of Ville (1939) and Shafer and Vovk (2001). Ayache’s contribution consists in continuing the argument from money through the material exchange of derivatives and the technology of their writing and pricing. When the advent of the Black-Scholes model is interpreted as a technological revolution, or a break outside the formalism of probability, which involves actors (market-makers) and technological means (writing of derivatives), it is shown that the market, thus understood in its full writing capacity, will recapture the full concreteness of the concrete world in ways that escape abstract probability theory and properly extend it. The consequence, however, is to give a new meaning to the word 'reality', which may be incompatible with the one issuing from possibility and probability.

Public Talk | Writing vs. Predicting: The cases of Pierre Menard (author of the Quixote) and the Financial Market with Elie Ayache

Thursday, June 8th | 8PM

The financial market is a material medium, in which contingent claims (a.k.a. financial derivatives) are exchanged and their prices are inscribed. Contingent claims are material contracts, bearing written material clauses, not abstract states bearing probabilities. Accordingly, the market does not produce a ‘calculation’ of the future — one that algorithmic trading might aspire to beat. Rather, the market has the nature of a book, binding in the same fabric the writing of derivatives and the writing of their prices. The market writes the future. It is the memory of the future, literally subtracted from probability and prediction. Insofar as he writes Cervantes' Quixote and doesn't rewrite it, writing it absolutely and not derivatively, totally outside prediction and the logic of the model and the copy, Pierre Menard has become the favorite vignette of this new philosophy of writing and pricing. With Pierre Menard, everything becomes possible. A true infinity opens up, and not just a replica of the one and the same. Menard is truly in contact with the future, and not, as we all might think, with the past.

Elie Ayache was born in Lebanon in 1966. Trained as an engineer at l’École Polytechnique of Paris, he pursued a career of option market-maker on the floor of MATIF (1987-1990) and LIFFE (1990-1995). He then turned to the philosophy of probability (DEA at la Sorbonne) and to the technology of derivative pricing, and co-founded the financial software company ITO 33 in 1999. Today, ITO 33 is the leading specialist in the pricing of convertible bonds, in the equity-to-credit problem, and more generally in the calibration and recalibration of volatility surfaces. Ayache has published numerous articles on the philosophy of contingent claims. He is the author of The Blank Swan: The End of Probability (2010), and of The Medium of Contingency: An Inverse View of the Market (2015).